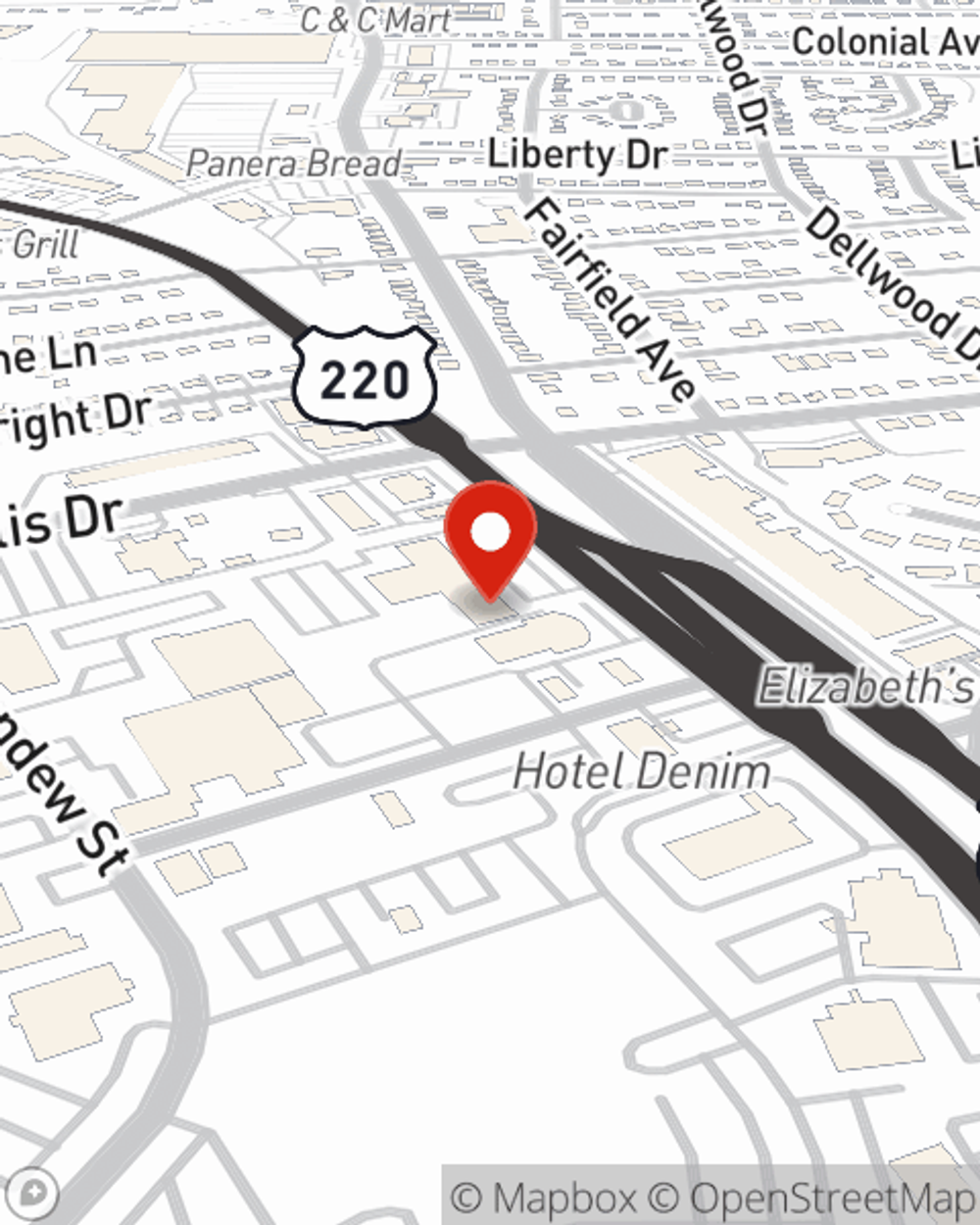

Insurance in and around Greensboro

A variety of coverage options to help meet your needs

Protect what matters most

Would you like to create a personalized quote?

- Winston Salem

- Lewisville

- Kernersville

- High Point

- Oak Ridge

- Burlington

- Stokesdale

- Charlotte

- Lake Norman

- Bermuda Run

- Clemmons

Let Us Help You Create A Personal Price Plan®

You’ve worked hard to get to where you are. But life can often throw the unexpected at you. Let State Farm® insurance help protect you, your loved ones and the life you’ve built. Create a coverage plan that protects what’s important to you – family, things and your bottom line. From safe driving rewards, bundling options and discounts, you can create a solution that’s right for you. Contact Rick Babusiak today for a Personalized Price Plan.

A variety of coverage options to help meet your needs

Protect what matters most

Insurance Products To Meet Your Ever Changing Needs

As the largest insurer of automobiles and homes in the U.S., State Farm is equipped and experienced when it comes to helping you protect the life you've built with great claims service, outstanding coverage options and excellent service.

Simple Insights®

The real costs of a non-moving or moving violation

The real costs of a non-moving or moving violation

Critical driving errors may end up draining your bank account and your free time. States vary in how they punish those mistakes and missteps, and it's helpful to know what's at stake.

How is car insurance calculated?

How is car insurance calculated?

Learn how car insurance is calculated, some common factors that affect car insurance rates and tips that may lower the premium.

Rick Babusiak

State Farm® Insurance AgentSimple Insights®

The real costs of a non-moving or moving violation

The real costs of a non-moving or moving violation

Critical driving errors may end up draining your bank account and your free time. States vary in how they punish those mistakes and missteps, and it's helpful to know what's at stake.

How is car insurance calculated?

How is car insurance calculated?

Learn how car insurance is calculated, some common factors that affect car insurance rates and tips that may lower the premium.